The bills are piling up, your paycheck is still three days away, and that overdraft fee just hit your account. Sound familiar? You’re not alone; millions of people find themselves in this exact spot every month, and traditional payday loans aren’t the answer anymore. With just a few taps on your phone, you can borrow a small amount and pay it back later. That’s why businesses are investing in mobile app development services to create user-friendly cash advance apps that meet these urgent financial needs.

Here’s the good news: the fintech revolution has birthed a whole new generation of cash advance apps that actually care about your financial health. These apps like Possible are rewriting the rules, offering instant access to money without the soul-crushing fees.

Let’s dive into the best options that’ll keep you afloat without drowning you in debt.

Why People Are Ditching Traditional Payday Loans

The payday loan industry has been bleeding customers for good reason. A 2023 Pew Research study revealed that 12 million Americans still use payday loans annually. The average payday loan costs $15 per $100 borrowed, and 80% of borrowers roll over their loans or borrow again within 14 days.

Modern loans like Possible Finance changed the game by offering:

- No credit check requirements for approval

- Instant funding options (sometimes within minutes)

- Transparent fee structures you can actually understand

- Credit-building features that help your score

- Flexible repayment schedules tied to your payday

The shift toward mobile app development in fintech has made these services accessible to anyone with a smartphone. Companies now leverage artificial intelligence to assess your creditworthiness using alternative data like bank account history and employment patterns, not just your FICO score.

How Cash Advance Apps Actually Work?

Before we jump into specific Possible Finance alternatives, let’s break down the mechanics. These apps connect directly to your bank account and analyze your income patterns, spending habits, and account balance. When you request an advance, the app approves you based on this real-time data.

Most platforms charge a monthly subscription fee (typically $3-$10) or request an optional tip instead of charging interest. Some combine both models. Your advance gets automatically deducted from your next paycheck, with most apps offering a grace period if you need extra time.

The technology behind these services involves sophisticated fintech app development that requires substantial investment.

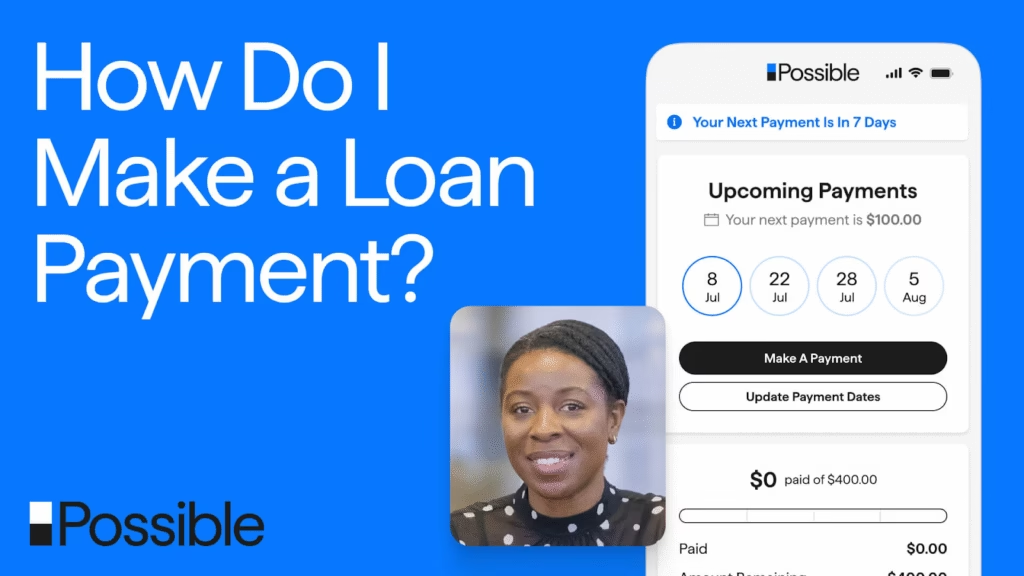

What Is Possible Finance?

Possible Finance is a popular cash advance app that allows you borrow small amounts of money when you’re in a pinch. You don’t need to worry about traditional credit checks, as Possible looks at your income and bank activity to determine if you qualify.

Here are some key features of Possible Finance:

- Borrow up to $500 instantaneously.

- No credit check is required to apply.

- Pay back in installments, not all at once.

- Helps you establish credit by reporting payments to credit bureaus.

- Quick and simple approval process.

- A user-friendly mobile app for controlling everything on your phone.

Top Apps Like Possible: Quick Comparison Table

| App Name | Advance Amount | Speed | Monthly Fee | Credit Check | Credit Building |

| Dave | $5-$500 | Instant | $1 | No | No |

| Earnin | $100-$750 | Instant | $0 (tips) | No | No |

| Brigit | $50-$250 | Instant | $9.99 | No | Yes |

| MoneyLion | $25-$500 | 12-48 hrs | $19.99 | Soft | Yes |

| Chime | $20-$200 | Instant | $0 | No | No |

| Albert | $25-$250 | Instant | $14.99 | No | Limited |

| Empower | $25-$250 | Instant | $8 | No | No |

| Cleo | $25-$250 | Instant | $5.99 | No | No |

| Current | $25-$200 | Instant | $4.99 | No | No |

| FloatMe | $10-$50 | Instant | $1.99 | No | No |

People looking for apps like Possible Finance often turn to community discussions for honest opinions. One popular thread on Quora explores recommendations for apps similar to Possible Finance, comparing options based on approval speed, repayment terms, and user experience.

The Complete Guide to Possible Finance Alternatives

If you’re searching for apps similar to Possible Finance, here are some top cash advance apps in the USA to consider:

Dave

Downloads: 10+ million

Rating: 4.7/5 (App Store), 4.5/5 (Play Store)

Dave entered the scene with a simple mission: help people avoid overdraft fees. The app monitors your checking account and alerts you when your balance runs low, offering small advances to cover the gap.

| Pros | Cons |

| Extremely low monthly membership cost | Lower maximum advance amount compared to competitors |

| Instant delivery available for small emergencies | Express fee for instant transfers can add up |

| Side hustle finder helps you earn extra income | Limited features in the free tier |

Best For: People who need occasional small advances under $200 and want overdraft protection without paying bank fees.

Earnin

Downloads: 10+ million

Rating: 4.7/5 (App Store), 4.4/5 (Play Store)

Earnin revolutionized the app like Possible concept by letting you access money you’ve already earned but haven’t been paid yet. Using GPS and timesheets, it verifies your work hours and unlocks your earnings daily.

| Pros | Cons |

| No mandatory fees, just optional tips | Requires location tracking for hour verification |

| The Lightning Balance feature provides instant access | Tips can feel pressured despite being “optional.” |

| Highest maximum advance among major competitors | Not available for all employment types. |

Best For: Hourly workers with regular schedules who want immediate access to earned wages without traditional payday loan fees.

If you’re comparing different platforms, check out our guide on Best App Like Brigit to Find the Right Money Management Alternative for more options.

Brigit

Downloads: 5+ million

Rating: 4.6/5 (App Store), 4.3/5 (Play Store)

Brigit combines cash advances with sophisticated financial planning tools, making it more than just a quick-fix solution. The platform’s AI analyzes your spending patterns and predicts when you’ll run short.

| Pros | Cons |

| Automatic advances prevent overdrafts before they happen | Higher monthly fee than some alternatives |

| Credit builder program reports to the major bureaus | Requires a consistent direct deposit history |

| Financial health score tracks your progress | Advance amounts are capped lower than those of some competitors |

Best For: Users who want comprehensive financial management alongside emergency cash access and are willing to pay for premium features.

For those exploring similar platforms, our blog on 10 Best Apps Like Earnin for Early Pay Access provides detailed comparisons.

MoneyLion

Downloads: 10+ million

Rating: 4.7/5 (App Store), 4.1/5 (Play Store)

MoneyLion evolved from a personal finance app into a comprehensive financial services platform. Beyond cash advances, it offers checking accounts, investment options, and credit-building loans.

| Pros | Cons |

| Highest feature set among competitors | Most expensive monthly membership fee |

| Credit Builder Plus loan reports to all three bureaus | Slower funding than instant-only competitors |

| Cashback rewards on purchases with a RoarMoney account | A complex tier system can be confusing |

Best For: Users seeking a complete banking alternative with investment opportunities, not just emergency cash access.

Chime

Downloads: 10+ million

Rating: 4.8/5 (App Store), 4.7/5 (Play Store)

Chime isn’t technically a cash advance app; it’s a complete banking platform with a killer overdraft feature. SpotMe lets you overdraw your account without fees, essentially providing interest-free microloans.

| Pros | Cons |

| Completely free with no monthly fees or hidden charges | Requires opening a Chime checking account |

| Automatic coverage with no applications required | Lower limits than dedicated advance apps |

| Early direct deposit arrives two days before payday | SpotMe limit increases slowly over time |

Best For: People willing to switch to Chime as their primary bank account who want automatic overdraft protection without traditional bank fees.

Albert

Downloads: 5+ million

Rating: 4.7/5 (App Store), 4.3/5 (Play Store)

Albert uses artificial intelligence to manage nearly every aspect of your financial life. The app’s “Genius” feature provides personalized advice from financial experts, while automated savings and investing tools work behind the scenes.

| Pros | Cons |

| Human financial advisors available via chat | Mid-range pricing without standout advance feaures |

| Automatic savings transfers based on spending patterns | Savings recommendations can be aggressive |

| Negotiates bills and cancels unused subscriptions | Customer service response times vary |

Best For: Users who want hands-off financial management with expert guidance, not just emergency cash access.

Empower

Downloads: 1+ million

Rating: 4.8/5 (App Store), 4.5/5 (Play Store)

Empower (formerly Personal Capital Cash) combines instant cash advances with investment tracking and retirement planning. The platform excels at showing your complete financial picture across multiple accounts.

| Pros | Cons |

| Competitive pricing with instant delivery included | Moderate advance limits compared to leaders |

| Powerful investment dashboard aggregates all accounts | Requires linking all financial accounts for the best experience |

| Auto-save feature based on customizable rules | Investment advice pushes toward fee-based management |

Best For: Young professionals building wealth who occasionally need cash advances while tracking their overall financial progress.

Cleo

Downloads: 5+ million

Rating: 4.7/5 (App Store), 4.4/5 (Play Store)

Cleo takes a radically different approach with its chatbot interface that delivers financial advice with attitude. The AI assistant roasts your spending habits while helping you save more and spend smarter.

| Pros | Cons |

| An entertaining interface makes financial management fun | Chatbot interface isn’t for everyone |

| Low monthly cost for cash advances and savings tools | Smaller maximum advance than premium competitors |

| Flexible repayment lets you pay advances back early | Limited customer service options |

Best For: Younger users who want an engaging, gamified approach to money management with occasional cash advance access.

Current

Downloads: 4+ million

Rating: 4.7/5 (App Store), 4.1/5 (Play Store)

Current offers teenage banking alongside adult accounts, making it unique among other apps like Possible. The platform combines cash advances, early paycheck access, and cashback rewards in one package.

| Pros | Cons |

| Teen accounts help kids learn financial responsibility | Moderate advance limits |

| The points system rewards regular use | Some features require maintaining specific balances |

| Overdrive advances are available instantly with no credit check | Cryptocurrency features are not available in all states |

Best For: Families wanting banking solutions for both adults and teens, with occasional emergency cash access included.

Understanding the What Is the Average Banking Mobile App Development Cost helps explain why these platforms charge the fees they do; building secure, compliant financial technology requires significant investment.

10. FloatMe

Downloads: 500,000+

Rating: 4.4/5 (App Store), 4.2/5 (Play Store)

FloatMe focuses specifically on preventing overdraft fees with small advances under $50. The minimalist approach keeps costs low while solving the specific problem of account gaps.

| Pros | Cons |

| Lowest monthly cost among paid services | Smallest maximum advance amount |

| Quick approval process with minimal requirements | Limited to users with regular direct deposits |

| Simple interface with no unnecessary features | No additional financial tools or credit building |

Best For: Users who only need tiny advances to avoid overdraft fees and prefer minimalist apps without extra features.

How Mobile App Development Shapes Modern Finance

The explosion of cash advance apps reflects broader mobile app development trends transforming how we interact with money. These platforms leverage technologies that didn’t exist a decade ago:

Real-time banking data connections through services like Plaid let apps analyze your financial situation instantly rather than waiting for credit reports. Machine learning algorithms assess risk using thousands of data points, approving users that traditional lenders would reject. Push notifications prevent overdrafts by alerting you before your account goes negative.

According to industry analysis, successful fintech apps prioritize user experience above all else. The Average Banking Mobile App Development Cost ranges from $40,000 for basic functionality to over $300,000 for enterprise-grade platforms. Still, the investment pays off through reduced customer acquisition costs and higher retention rates.

Building the Future of Finance with Liquid Technologies

While consumer-facing apps solve immediate cash flow problems, the technology behind these platforms represents something bigger: a fundamental rethinking of how financial services should work.

Liquid Technologies architects financial ecosystems that challenge outdated assumptions. When legacy banks see risky borrowers, we see data patterns that predict repayment better than credit scores. Where traditional lenders see obstacles, we see opportunities to serve underbanked communities.

The future of fintech isn’t about replacing banks. It’s about creating parallel systems that serve people banks ignore. Our development philosophy emphasizes:

- User-centric design that removes friction from every interaction.

- Alternative credit assessment using employment data, cash flow patterns, and even social signals.

- Transparent pricing that builds trust instead of hiding fees in fine print.

We’ve helped launch platforms serving millions of users, processing billions in transactions, and genuinely improving financial outcomes for people that traditional systems failed.

Common Mistakes to Avoid with Cash Advance Apps

- Treating advances as extra income: These apps bridge temporary gaps, not supplement your regular earnings. Using them consistently signals deeper budgeting problems that need addressing.

- Ignoring the repayment date: Advances are withdrawn automatically on your designated payday. If you’ve spent that money elsewhere, you’ll face overdraft fees that defeat the entire purpose.

- Maxing out immediately: Start with small advances to test the system and ensure repayment fits comfortably in your budget. Building your limit gradually shows financial discipline.

- Subscribing to multiple services: Having three apps all charging monthly fees quickly erases any savings versus traditional loans. Pick one that fits your needs and stick with it.

- Skipping the budgeting tools: The apps that include spending trackers and savings features provide them for a reason, use them to address the root causes of cash flow problems.

For developers and entrepreneurs interested in entering this space, understanding the fintech app development cost guide provides realistic expectations for building competitive platforms.

Transform Your Financial Future: Beyond Quick Fixes

These apps like Possible, solve immediate problems, but lasting financial security requires addressing root causes. Consider these parallel strategies:

Build a starter emergency fund: Even $500 eliminates most scenarios requiring cash advances. Automatic savings transfers of just $25 per paycheck create this buffer within 20 weeks.

Audit your subscriptions: Americans waste an average of $273 monthly on unused subscriptions. Cutting just two frees up advance money that currently goes toward fees.

Explore side income: The gig economy offers dozens of ways to earn extra money on your schedule. Many of these apps include job boards to help you find opportunities.

Final Thoughts

The success of loans like Possible Finance proves that massive markets exist for financial products that actually help people. If you’re an entrepreneur or an established company looking to enter this space, the opportunity is enormous, but so are the technical and regulatory challenges.

Want to discuss your fintech vision? Let’s talk about how Liquid Technologies can bring your concept to life with secure, scalable, user-focused development.